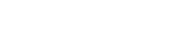

A new book by Jerry Buckland a professor at Menno Simons College, a Canadian Mennonite University institution in downtown Winnipeg, reveals how Canada’s banking system excludes the poor.

In Hard Choices: Financial Exclusion, Fringe Banks and Poverty in Urban Canada, published this year by the University of Toronto Press, Buckland takes an in-depth look at the tough choices low-income people living in Canada’s inner cities face.

Data demonstrate that over the past 30 years mainstream banks and credit unions are abandoning low-income neighbourhoods, while the business of fringe financial services—such as pawn shops, cheque-cashers and payday lenders—booms. These fringe banks often charge far higher service fees; payday lenders in Manitoba charge up to $51 on a $300 two-week loan.

“Low-income people often do an amazing job of managing a very tight budget, frequently without access to credit or any reasonably priced credit,” says Buckland.

Buckland’s research team conducted interviews with people facing financial challenges in inner-city neighbourhoods in Winnipeg, Toronto and Vancouver. Although the qualitative interviews don’t serve as statistical data, they depict the real-life “perspective of low-income Canadians and the hard choices they have to make about financial services,” says Buckland, who fleshes out the big picture using data from national surveys, statistics and policy documents.

The author hesitates to heap too much blame on fringe bankers themselves. “I’m ambiguous about fringe bankers,” he says. “I’m unwilling to say that just because they’re operating a fringe bank they’re exploiting poor people. But I’m also unwilling to say that low-income people aren’t being harmed. It’s systematic exploitation when poor people end up paying more for dead-end financial services. The system is failing.”

Part of the problem is that most mainstream banks aren’t very interested in serving the poor, Buckland’s book suggests. “Banks just aren’t very interested in having low-income people saving money, so they don’t set up the systems needed to do so,” he says.

Comments

I am trying to put my memories way back and now. May I ask you this question: Are you Jerry Buckland who work for Mennonites in Noakhali, Bangladesh? It seems your books reflect humanity, concern for the poor which is our responsibility.

I was in Noakhali Sister Convent. Hope we can connect again.

Thanks

Add new comment

Canadian Mennonite invites comments and encourages constructive discussion about our content. Actual full names (first and last) are required. Comments are moderated and may be edited. They will not appear online until approved and will be posted during business hours. Some comments may be reproduced in print.